The Risk Management in the Best Ways for You

By Lenard Jessie

Anyone who wants to make a lot of money in the long term must invest in equities, according to the opinion of professional traders. Which ten rules to consider before buying a share can be read here?

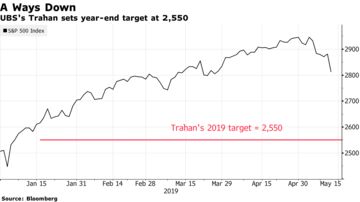

More and more people are interested in shares. In the past, when they were frowned upon, people had to resort to an alternative rate of interest of less than one percent. Securities are therefore just as lucrative as ever. Exchange experts know that too. The UBS Yield Enhancement Strategy works perfectly there. But for whom the securities business is completely new territory, should heed these tips before he plunges into the stock trading:

Set up a custody account

Before you can go public, you need an account to manage all transactions. You can open this with your house bank, direct banks as well as so-called discount brokers.

The latter have the advantage of often offering free custody account management. In addition, it is advisable to opt for a provider that requires transaction fees of five to ten dollars. On comparison websites on the Internet, you will find the right provider for you. If you find a cheaper deal, you can always switch. However, this can take up to six weeks.

Define investment duration

Securities are a long-term investment that can yield profits. This is not a quick shot to get rich. This should be aware of stock newcomers.

Therefore, you should consider before you buy, how long you want to hold the shares: Especially for beginners, it is important that they keep shares in the portfolio at least three years. Experts even recommend six years as a holding period.

After all, there are always price fluctuations, but overall, you will achieve more profits in the long run. This strategy is called ‘buy and hold’. Buying and holding is even recommended by big stockbrokers and that is still relevant today says the expert.

Choose a stock universe

There are thousands of international and national securities to choose from before making a purchase. To narrow down the selection, you should initially focus on the Dax and the Mdax. Then you still have the large number of 80 stocks to choose from, but they are liquid assets that you can easily buy and sell.

Put on dividend-strong companies

The carmaker Daimler is known among stockbrokers and popular for often pay high dividends. And you should start putting more emphasis on such companies at the beginning, advises the expert. With a dividend, a group finally contributes its shareholders to the profits. Even if the performance of a stock disappoints within a year, you will at least get a good dividend yield.

Set depot weighting

If you have decided on stocks, you should consider before investing how much money you want to invest in which. At first, such an estimate seems risky but to be on the safe side, the professional trader gives the following example: If an investor launches a deposit of 5,000 dollars, he should invest about 7-8 percent per share.

ETFs as an alternative

Those who do not want to spend so much effort should take a closer look at equity funds. These so-called ETFs are passively managed index funds in which several selected securities are already bundled. With a monthly savings plan or a one-time, larger investment, you can invest in the entire index. This is a safe and time-saving alternative to single stocks.